Why Classic Cars Are Accelerating as Investments

The burgeoning appeal of classic cars as an investment class is multifaceted, driven by a unique blend of economic factors, changing demographics, and the inherent characteristics of the vehicles themselves.

A. Tangible Asset Appeal

In an increasingly digital and volatile financial world, classic cars offer the reassuring solidity of a tangible, physical asset.

- Hedge Against Inflation: Historically, many classic cars have proven to be excellent hedges against inflation, as their values tend to rise with the general cost of goods and services, often outperforming traditional currencies in periods of high inflation.

- Diversification from Traditional Markets: Investing in classic cars provides a valuable alternative to stocks, bonds, and real estate. This diversification can reduce overall portfolio risk, especially during periods of market volatility, as their performance is often uncorrelated with mainstream financial markets.

- Intrinsic Value: Unlike paper assets, classic cars possess intrinsic value derived from their craftsmanship, historical significance, engineering, and cultural impact. This underlying value offers a degree of stability not always found in purely speculative investments.

- Physical Ownership: There’s a deep satisfaction in owning a physical, beautiful object that can be seen, touched, driven, and admired. This physical presence and emotional connection are powerful drawcards that digital assets cannot replicate.

- Portable Wealth: High-value classic cars can represent a form of portable wealth, offering flexibility for owners who may operate across different countries or jurisdictions.

The tangible nature of classic cars provides a sense of security and enjoyment that purely financial instruments often lack.

B. Supply and Demand Dynamics

The fundamental economic principles of supply and demand are powerfully at play in the classic car market, favoring appreciation.

- Finite Supply: The number of truly desirable classic cars is inherently limited. No new “classic” cars from past eras are being made. As these vehicles age and some are lost, damaged, or become unavailable, the existing pool shrinks, increasing scarcity.

- Increasing Demand: The global pool of affluent individuals and passionate collectors is growing, particularly in emerging markets, leading to increased competition for desirable models. As wealth expands, so does the interest in unique luxury assets.

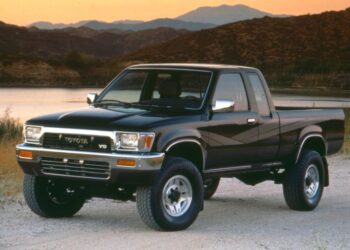

- Demographic Shifts: As baby boomers, who often have significant disposable income and nostalgia for cars from their youth, continue to enter or expand their collecting, demand remains robust. Simultaneously, younger generations, discovering the beauty and history of these machines, are also entering the market, ensuring continued demand.

- Historical Significance: Cars with significant racing provenance, celebrity ownership, or unique design stories command higher premiums, further limiting the truly desirable supply.

- Limited Production Runs: Many of the most sought-after classics were produced in very limited numbers even when new, making them inherently rare and desirable today.

This imbalance, with limited and often shrinking supply meeting expanding global demand, is a primary driver of rising values.

C. Cultural and Nostalgic Value

Beyond their financial attributes, classic cars tap into deep-seated emotional and cultural connections.

- Nostalgia and Personal Connection: Many collectors are drawn to cars from their formative years, evoking memories of youth, freedom, and a bygone era. This emotional resonance can drive significant bidding wars.

- Art and Design: Classic cars are often viewed as moving sculptures, embodying the pinnacle of automotive design and engineering from their period. Their aesthetic appeal transcends their function.

- Historical Significance: Owning a classic car means owning a piece of history, a tangible link to technological advancements, cultural shifts, and iconic moments in automotive evolution.

- Social Status and Prestige: Driving or owning a rare and beautiful classic car often confers significant social status and prestige, acting as a statement of taste and financial success.

- Passion and Hobby: For many, collecting and restoring classic cars is a deep-seated passion, providing enjoyment and intellectual engagement that goes beyond mere financial return. This passion helps sustain market interest even through economic fluctuations.

- Community and Events: The classic car world boasts a vibrant global community, with rallies, concours d’elegance events, and car shows providing opportunities for owners to connect, share knowledge, and display their vehicles.

This unique blend of passion and prestige helps to underpin and sustain market values.

D. Professionalization of the Market

The classic car market has matured from informal transactions to a sophisticated, transparent, and globally interconnected industry.

- Reputable Auction Houses: Major auction houses (e.g., RM Sotheby’s, Gooding & Company, Bonhams, Barrett-Jackson) now dominate high-value sales, bringing transparency, rigorous vetting, and global reach.

- Specialized Dealers: Expert dealers with deep knowledge of specific marques and models provide curatorial advice, sourcing, and authentication services.

- Independent Valuers and Appraisers: Professional appraisers offer unbiased valuations, crucial for insurance, sales, and estate planning.

- Dedicated Media and Data Analytics: Publications, online platforms, and data providers (e.g., Hagerty, Classic Car Auction Yearbook) track market trends, auction results, and provide insights, allowing for more informed investment decisions.

- Specialized Financing and Insurance: Banks and insurance companies now offer tailored products specifically for classic car acquisition and protection, reflecting the market’s maturity.

- Restoration and Maintenance Experts: A global network of highly skilled specialists is available for authentic restoration and meticulous maintenance, preserving the value of these complex machines.

This increased professionalization has brought greater liquidity, transparency, and confidence to the market, attracting more sophisticated investors.

E. Global Wealth Accumulation

The rapid growth of wealth, particularly in emerging economies, is expanding the pool of potential classic car investors worldwide.

- Increased Disposable Income: As wealth accumulates globally, a larger segment of the population has the discretionary income to invest in luxury and passion assets.

- Emerging Markets: New collectors and investors from regions like Asia, the Middle East, and South America are entering the classic car market, bringing fresh capital and diversifying demand.

- Desire for Unique Assets: High-net-worth individuals often seek unique, tangible assets that offer both enjoyment and investment potential, distinguishing them from more common luxury goods.

- Cross-Border Transactions: The professionalization of shipping and logistics has made it easier to buy and sell classic cars across international borders, expanding the market’s reach.

The global nature of wealth creation directly fuels the classic car investment boom.

Identifying Investment-Grade Classics

Not all old cars are classics, and not all classics are good investments. Identifying potential appreciation requires a nuanced understanding of market dynamics and specific vehicle attributes.

A. Rarity and Exclusivity

Scarcity is a fundamental driver of value in any collectible market.

- Limited Production Numbers: Cars produced in very small quantities when new (e.g., Ferrari 250 GTO, Porsche 911 Carrera RS 2.7) are inherently rare and highly sought after.

- Survivor Cars: Original, unrestored cars that have been exceptionally well-preserved are incredibly rare and often command a premium due to their authenticity.

- Unique Specifications: Cars with unusual factory options, bespoke coachwork, or one-off modifications from renowned tuners can be particularly exclusive.

- Disappearing Models: As certain models age, attrition due to accidents or neglect further reduces their numbers, increasing the value of surviving examples.

Rarity creates an exclusive club of ownership, driving up demand.

B. Marque and Model Pedigree

The reputation of the manufacturer and the significance of the specific model play a crucial role.

- Established Marque Value: Brands with a strong racing heritage, engineering excellence, and a history of producing desirable vehicles (e.g., Ferrari, Porsche, Mercedes-Benz, Aston Martin, Bugatti, Lamborghini) typically hold their value well.

- Iconic Models: Certain models within a marque’s history achieve iconic status due to their design, performance, or cultural impact (e.g., Mercedes-Benz 300SL Gullwing, Ford Mustang Shelby GT500, Jaguar E-Type).

- Racing Provenance: Cars with a verifiable racing history, especially those driven by famous drivers or that won significant races, command significant premiums.

- Technological Milestones: Vehicles that introduced groundbreaking technology or represented a significant leap forward in automotive engineering can be highly collectible.

- Design Influence: Cars whose aesthetics profoundly influenced subsequent automotive design trends are often prized for their artistic merit.

A strong pedigree provides a historical and emotional anchor for value.

C. Condition and Authenticity

The state of a classic car and its originality are paramount to its investment potential.

- Originality: Cars that retain their original engine, transmission, body panels (“matching numbers”), and even interior components are highly prized. Unrestored but well-preserved “survivors” can be even more valuable than perfectly restored examples.

- Concours-Level Restoration: For restored cars, the quality of the restoration is critical. A meticulous, authentic restoration by a renowned specialist can significantly enhance value. Poor or incorrect restorations can devalue a car.

- Documentation and History: A complete paper trail, including original sales invoices, service records, ownership history, and restoration receipts, adds immense value and validates authenticity.

- Verification and Certification: Third-party verification (e.g., Ferrari Classiche, Porsche Classic) can authenticate a car’s originality and provenance, providing confidence to buyers.

- Mechanical Soundness: Beyond aesthetics, the car must be mechanically sound and ideally capable of being driven, even if rarely.

A car’s condition and documented authenticity are non-negotiable for serious investment.

D. Driveability and Usability

While investment is key, a car that can be enjoyed adds to its appeal.

- Enjoyment Factor: Cars that are genuinely enjoyable to drive, even if challenging, tend to hold appeal and demand.

- Maintenance Support: The availability of spare parts and skilled mechanics to maintain the car is crucial for long-term ownership and preserving value. Cars with readily available parts and established service networks are often preferred.

- Reliability: While classic cars require more maintenance than modern vehicles, a reputation for reasonable reliability makes them more attractive to a wider pool of potential owners.

- Roadworthiness: The ability to register and drive the car on public roads, where legal, adds to its utility and appeal, allowing owners to participate in rallies and events.

A balance between investment potential and the ability to enjoy the vehicle is often sought.

Strategies and Considerations

Investing in classic cars is complex and requires careful consideration beyond just picking a desirable model.

A. Due Diligence is Paramount

Thorough research and inspection are non-negotiable before any purchase.

- Expert Inspection: Always commission a pre-purchase inspection (PPI) by an independent, reputable specialist who knows the specific make and model. This can uncover hidden issues that could cost a fortune.

- Historical Research: Verify the car’s provenance, ownership history, service records, and any racing history. Use dedicated resources and archives.

- Market Analysis: Study auction results, sales data, and market trends for the specific model and comparable vehicles. Understand what factors are driving recent sales.

- Authenticity Checks: Ensure “matching numbers” (original engine, chassis, transmission) and verify the authenticity of components, especially for rare models. Counterfeits can exist.

- Legal Clearances: Confirm clear title, absence of liens, and full legal right to sell. International purchases can involve complex import/export regulations and taxes.

Neglecting due diligence is the quickest way to turn an investment into a money pit.

B. Storage and Maintenance Costs

Classic cars are not “set and forget” investments; they require significant ongoing care.

- Specialized Storage: Climate-controlled, secure storage is often necessary to prevent rust, deterioration, and theft, which can be expensive.

- Regular Maintenance: Even if not driven frequently, classic cars require regular, specialized maintenance from experienced mechanics to prevent components from seizing or deteriorating.

- Restoration Costs: If a car requires restoration, it can be extremely expensive, potentially exceeding the car’s future value if not managed carefully. Authenticity and quality are key to justifying costs.

- Insurance: Specialized classic car insurance is essential, often with specific requirements for storage and usage.

- Depreciation of Non-Classic Parts: While the car itself may appreciate, modern tires, fluids, and non-original service parts will depreciate and need regular replacement.

These ongoing costs must be factored into the overall investment calculation.

C. Market Volatility and Cycles

While the long-term trend has been upward, the classic car market can experience fluctuations.

- Economic Sensitivity: While often uncorrelated with mainstream markets, severe economic downturns can still impact discretionary spending and classic car values.

- Trend Dependence: Certain models or eras can become “hot” and then cool off. Investing requires anticipating long-term appeal, not just short-term fads.

- Generational Shifts: As different generations enter and exit the market, the types of cars considered desirable may change (e.g., preference for 80s/90s cars by younger collectors).

- Bubble Concerns: Some critics warn of “bubbles” in certain segments of the market, driven by speculative buying. Careful analysis of underlying demand vs. speculative fervor is needed.

- Succession Planning: As collectors age, the market may see an influx of cars from estates, potentially impacting supply.

A long-term perspective and diversification within the classic car portfolio can mitigate some of these risks.

D. Liquidity Considerations

Classic cars, especially high-value ones, are not as liquid as stocks or bonds.

- Selling Timeframe: Selling a rare or expensive classic car can take time, sometimes months or even years, to find the right buyer at the right price.

- Transaction Costs: Auction fees (buyer’s premium and seller’s commission), transportation costs, and marketing expenses can be significant.

- Niche Market: The buyer pool for truly high-end or obscure classics is limited, requiring a global reach to find the right enthusiast.

- Market Timing: Selling at the peak of a specific model’s popularity can yield better returns, but timing the market is difficult.

Investors should be prepared for a less liquid asset than traditional financial instruments.

E. Authenticity and Provenance Verification

The rise in value has unfortunately led to a rise in fakes and misrepresented cars.

- “Matching Numbers” Importance: Verifying that the car retains its original engine, transmission, and other key components is crucial. Re-stamped numbers or swapped engines can significantly devalue a car.

- Recreation vs. Original: Understanding the difference between an authentic original car, a period-correct restoration, and a modern recreation or replica is vital. Only originals or meticulous restorations hold significant investment value.

- Historical Accuracy: Ensuring that any restoration work is historically accurate and uses correct parts and techniques from the period.

- Document Forgery: The possibility of forged documentation or manipulated service records exists, requiring careful scrutiny by experts.

- Expert Verification: Relying on independent experts, marque specialists, and certified bodies for authentication is essential to protect an investment.

Protecting authenticity is a continuous effort in the classic car market.

Conclusion

The classic car investment rise is a powerful testament to the enduring appeal of these magnificent machines. Driven by their tangible nature, inherent scarcity, profound cultural significance, and a professionalizing market, classic cars offer a unique investment opportunity that blends financial returns with unparalleled emotional satisfaction. While requiring careful due diligence, significant ongoing costs, and an understanding of market dynamics, the long-term outlook remains strong. As global wealth continues to grow and appreciation for automotive history deepens across generations, these rolling works of art are set to accelerate further in value. Investing in a classic car is not merely a financial decision; it’s an embrace of passion, history, and a tangible piece of engineering brilliance that continues to captivate hearts and portfolios alike. The journey of automotive investment has truly become an exhilarating ride.