Catalysts of the Global Auto Industry Shifts

The unprecedented changes sweeping through the automotive sector are propelled by several powerful, interconnected forces. Understanding these catalysts is crucial to grasping the magnitude and direction of the industry’s transformation.

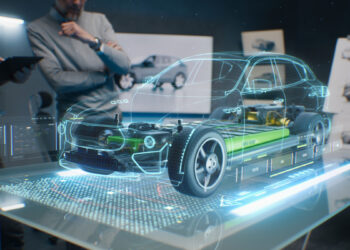

A. The Electrification Revolution

Perhaps the most significant and visible shift is the accelerating transition from gasoline and diesel to electric powertrains. This is not merely an alternative; it is becoming the new standard.

- Environmental Imperatives: Global climate change concerns and increasing awareness of air pollution in urban centers are pushing for zero-emission vehicles. Governments worldwide are setting aggressive targets for phasing out ICE sales.

- Battery Technology Breakthroughs: Rapid advancements in battery energy density, charging speed, cost reduction, and safety are making Electric Vehicles (EVs) increasingly practical and appealing. The cost per kilowatt-hour (kWh) continues to fall, nearing parity with ICE.

- Government Policies and Incentives: Tax credits, rebates, subsidies for charging infrastructure, and stricter emissions regulations are directly incentivizing EV adoption and production globally.

- Lower Running Costs: Electricity is often cheaper than gasoline, and EVs typically have lower maintenance requirements due to fewer moving parts, leading to lower total cost of ownership.

- Enhanced Driving Experience: EVs offer instant torque, quiet operation, and smooth acceleration, providing a refined and often exhilarating driving experience that appeals to a growing number of consumers.

- Growing Charging Infrastructure: Significant investments are being made by governments, private companies, and utilities to expand public and private charging networks, alleviating “range anxiety.”

The electrification revolution is fundamentally altering vehicle design, manufacturing processes, and supply chains, with massive investments pouring into battery production and charging infrastructure.

B. Autonomous Driving Development

The promise of self-driving cars, once science fiction, is now a tangible reality under rapid development, poised to revolutionize road safety and efficiency.

- Enhanced Safety: Human error is responsible for the vast majority of accidents. Autonomous vehicles (AVs), free from distraction, fatigue, or impairment, have the potential to drastically reduce collisions, fatalities, and injuries.

- Improved Traffic Flow: AVs can communicate and react with precision, leading to optimized traffic flow, reduced congestion, and more efficient use of road infrastructure through technologies like platooning.

- New Mobility Services: Autonomous technology enables the rise of robotaxis, self-driving delivery vehicles, and mobile offices, changing how goods and people move.

- Increased Accessibility: AVs can provide mobility and independence for individuals who are currently unable to drive, such as the elderly or those with disabilities.

- Productivity Gains: Passengers in AVs can use travel time for work, relaxation, or entertainment, turning commutes into productive or leisure time.

- Advanced Sensor and AI Technologies: Sophisticated sensors (Lidar, radar, cameras), powerful computing, and advanced Artificial Intelligence (AI) algorithms are enabling vehicles to perceive, predict, and plan their movements with increasing accuracy.

While challenges remain in regulation, public acceptance, and addressing complex “edge cases,” autonomous driving is rapidly progressing through SAE levels, starting with advanced driver-assistance systems (ADAS) and moving towards full autonomy in controlled environments.

C. The Connected Car Ecosystem

Vehicles are no longer isolated machines; they are becoming intelligent, mobile nodes within a vast digital network, constantly communicating and exchanging data.

- Ubiquitous Connectivity: Embedded modems (4G/5G), seamless smartphone integration (Apple CarPlay, Android Auto), and Vehicle-to-Everything (V2X) communication (V2V, V2I, V2P) enable real-time data exchange.

- Enhanced Safety Features: Connected cars can receive real-time hazard warnings, alert emergency services automatically after a crash (eCall), and aid in collision avoidance through shared information.

- Personalized Infotainment: Access to streaming media, integrated voice assistants, and customized in-car experiences based on driver preferences.

- Over-the-Air (OTA) Updates: Manufacturers can remotely deploy software updates for bug fixes, performance enhancements, and new features, extending the vehicle’s lifespan and capabilities without dealership visits.

- Predictive Maintenance: Vehicle sensors transmit data to diagnose potential issues remotely, allowing for proactive servicing and reducing breakdowns.

- Data Monetization: Anonymized and aggregated vehicle data can be valuable for urban planning, traffic management, insurance, and new service development.

The connected car forms the digital nervous system of future mobility, integrating vehicles into smart city infrastructures and enabling new service models.

D. Evolution of Mobility Models (Mobility-as-a-Service – MaaS)

The traditional model of individual car ownership is being complemented and challenged by new ways of accessing transportation.

- Shift from Ownership to Access: A growing preference, particularly among younger generations, for convenient, on-demand access to transportation rather than the burden of vehicle ownership (purchase, insurance, maintenance, parking).

- Mobility-as-a-Service (MaaS) Platforms: Integrating various transport options (public transit, ride-sharing, bike-sharing, e-scooters, car-sharing) into a single, seamless digital platform for planning, booking, and payment.

- Shared Mobility: The expansion of services like Uber, Lyft, Grab, Gojek, and dedicated car-sharing fleets (e.g., Zipcar, ShareNow) reduces the number of privately owned vehicles needed.

- Subscription Models for Vehicles: Some companies offer vehicle subscriptions, where consumers pay a monthly fee for access to a car, often with insurance and maintenance included, without the commitment of purchase.

- Micro-Mobility: The rise of e-scooters and e-bikes for “first and last mile” urban travel, complementing public transit and reducing short-distance car use.

- New Urban Planning: Cities are rethinking infrastructure to support multi-modal transport, prioritizing pedestrians, cyclists, and shared electric vehicles over private car parking.

These new models aim to reduce congestion, improve efficiency, and offer more flexible and sustainable transportation options.

E. Changing Consumer Expectations

Beyond technology, consumer behaviors and priorities are significantly influencing the industry.

- Sustainability Consciousness: Growing demand for eco-friendly products and services, driving the adoption of EVs and sustainable manufacturing practices.

- Digital Integration: Consumers expect seamless integration of their digital lives (smartphones, apps, smart homes) with their vehicles.

- On-Demand Convenience: A preference for immediate, app-based services and personalized experiences across all aspects of life, including transportation.

- Personalization: Desire for vehicles that can be customized to individual preferences, from interior settings to driving modes.

- Safety and Trust: A heightened awareness of vehicle safety features and a need for transparency regarding autonomous systems and data privacy.

- Experience Over Ownership: For some, the driving experience or the utility of transportation is prioritized over the pride of owning a depreciating asset.

Manufacturers must adapt their product development, sales, and service models to meet these evolving expectations.

How the Industry is Adapting

The global auto industry is responding to these shifts with massive strategic investments, reorganizations, and new partnerships.

A. Massive Investment in R&D

Automakers are pouring billions into research and development for new technologies.

- Electrification Platforms: Developing dedicated EV architectures (skateboard platforms) that optimize battery packaging, range, and interior space.

- Battery Technology: Investing in battery cell R&D, establishing joint ventures with battery manufacturers, and building “gigafactories” for large-scale production.

- Software Development: Shifting focus from hardware-centric engineering to software-defined vehicles, hiring vast numbers of software engineers and AI specialists.

- Autonomous Driving Systems: Investing in sensor technology, AI algorithms, and testing infrastructure for self-driving capabilities.

- Sustainable Materials: Researching and implementing recycled content, bio-based materials, and innovative lightweight alloys.

This monumental R&D effort is reshaping corporate structures and talent acquisition.

B. Reimagining Manufacturing and Supply Chains

The shift to EVs and sustainable practices requires a fundamental overhaul of production.

- Flexible Manufacturing: Plants are being reconfigured to produce both ICE and EV models, or entirely new EV-dedicated facilities are being built.

- Battery Production Integration: Automakers are bringing battery cell and pack manufacturing in-house or forming deep partnerships to secure supply and reduce costs.

- Localized Supply Chains: Efforts to onshore or nearshore critical component production (especially batteries and semiconductors) to reduce geopolitical risks and increase resilience.

- Circular Economy Principles: Designing vehicles for disassembly, promoting recycling of materials (e.g., battery recycling), and increasing the use of recycled content in new vehicles.

- Sustainable Factories: Transitioning manufacturing facilities to run on renewable energy, reducing water usage, and minimizing waste generation.

- Digitalization of Production: Implementing AI, robotics, and big data analytics in manufacturing to improve efficiency, quality control, and reduce environmental impact.

This transformation of the supply chain is one of the most complex and capital-intensive aspects of the industry shift.

C. Shifting Sales and Distribution Models

The traditional dealership model is also undergoing significant changes.

- Direct-to-Consumer Sales: Some EV startups and even established automakers are experimenting with online sales platforms, bypassing traditional dealerships for a more streamlined purchasing experience.

- Agency Model: Dealerships may transition from owning inventory to acting as agents for manufacturers, focusing more on service and customer experience.

- Online Customization and Ordering: Digital tools allow customers to configure and order vehicles online, reducing reliance on physical showrooms.

- Subscription and Leasing Focus: Increased emphasis on flexible ownership models like subscriptions and long-term leases, especially for EV adoption.

- Service and Charging Networks: Dealerships are adapting to become charging hubs and service centers for EVs, requiring new training and equipment.

- Customer Experience Focus: A greater emphasis on a seamless, personalized customer journey from initial inquiry to after-sales support.

The sales model is evolving to meet digital-savvy consumer expectations and the unique demands of EVs.

D. New Partnerships and Competitors

The complexity of the transformation is fostering unprecedented collaborations and attracting new players.

- Tech Company Partnerships: Automakers are partnering with tech giants (Google, Apple, NVIDIA, Intel) for software, AI, and autonomous driving solutions.

- Battery Joint Ventures: Collaborations between automakers and battery manufacturers to secure supply, reduce costs, and develop next-generation battery tech.

- Mobility Service Providers: Automakers are investing in or acquiring ride-sharing companies, car-sharing platforms, and micro-mobility providers to diversify into mobility services.

- New Entrants (EV Startups): Companies like Tesla, Rivian, Lucid, and Nio have disrupted the market, forcing legacy automakers to accelerate their EV strategies.

- Cross-Industry Alliances: Collaborations with energy companies for charging infrastructure, and with telecommunications providers for connectivity solutions.

- Vertical Integration: Some automakers are attempting to bring more aspects of the value chain (e.g., battery cell production, software development) in-house.

The competitive landscape is becoming more dynamic, with blurred lines between traditional auto, tech, and energy sectors.

E. Talent Acquisition and Workforce Reskilling

The nature of jobs in the automotive industry is fundamentally changing.

- Demand for Software and AI Engineers: A massive surge in demand for talent in software development, AI, machine learning, data science, and cybersecurity.

- Electrical Engineers: Increased need for expertise in battery management systems, power electronics, and electric powertrains.

- Battery Scientists and Material Scientists: Critical roles in developing next-generation battery chemistries and lightweight materials.

- Workforce Reskilling: Legacy automakers are investing heavily in retraining their existing workforce (e.g., engine builders transitioning to EV assembly, technicians learning EV diagnostics).

- Cultural Shift: Fostering a more agile, tech-focused, and innovative culture within traditionally hierarchical automotive companies.

- Global Talent Hunt: Competition for specialized talent is intense, leading to global recruitment efforts.

Managing this workforce transformation is a key internal challenge for automakers.

The Broader Impact for Society and Economies

The shifts in the global auto industry will have far-reaching consequences beyond the corporate bottom line, impacting cities, energy grids, and individual lives.

A. Urban Transformation

Cities are set to undergo significant changes as mobility paradigms shift.

- Cleaner Air and Quieter Streets: Mass adoption of EVs will drastically reduce urban air and noise pollution, leading to healthier and more pleasant living environments.

- Reduced Congestion: Autonomous vehicles, optimized traffic management, and shared mobility services can significantly alleviate traffic jams and improve flow.

- Reclaiming Urban Space: Less demand for extensive parking lots could free up valuable land for green spaces, housing, or pedestrian zones.

- Smart City Integration: Vehicles will become integral sensors and actuators within intelligent urban ecosystems, facilitating dynamic traffic management and emergency response.

- New Infrastructure Needs: Development of widespread charging infrastructure, V2X communication networks, and potentially new urban air mobility hubs (vertiports).

Future cities will be designed around people and sustainable mobility, not just private cars.

B. Energy Grid Modernization

The electrification of transport will deeply integrate the automotive sector with the energy sector.

- Increased Electricity Demand: A significant rise in electricity consumption, requiring substantial investment in generation (ideally renewable) and transmission infrastructure.

- Grid Stability: EV batteries can act as distributed energy storage, helping to balance the grid by charging during off-peak hours and potentially returning energy (V2G) during peak demand.

- Smart Charging Networks: Intelligent systems that optimize EV charging times to align with renewable energy availability and grid demand, preventing blackouts.

- Decentralized Energy Production: Encouraging local energy generation (e.g., solar on homes, businesses) to support distributed charging.

The future of energy and transportation are inextricably linked, driving massive investments in grid modernization.

C. Economic Realignment

The industry’s transformation will create new economic opportunities and disrupt existing ones.

- Growth of Green Industries: Expansion in sectors like renewable energy, battery manufacturing, recycling, and smart infrastructure development.

- Shift in Employment: Creation of new jobs in tech, software, AI, and green manufacturing, while potentially reducing jobs in traditional ICE-related fields.

- New Revenue Streams: Growth of subscription services, data monetization, and mobility-as-a-service models.

- Reduced Oil Dependence: Countries and consumers will become less reliant on volatile fossil fuel markets.

- Increased Productivity: Reduced commuting times and the ability to work/relax during transit can boost overall economic productivity.

This economic realignment requires careful planning and investment in workforce reskilling and infrastructure.

D. Social Equity and Accessibility

New mobility solutions have the potential to foster more inclusive societies.

- Enhanced Mobility for All: Autonomous and shared electric vehicles can provide greater independence and access to jobs, healthcare, and education for the elderly, individuals with disabilities, and those without private vehicle ownership.

- Reduced Transportation Burden: Lower costs and increased options can alleviate financial strain on households.

- Safer Roads: Fewer accidents due to autonomous technology and enhanced connectivity will lead to safer communities for all.

- Improved Public Health: Cleaner air and quieter environments contribute to better health outcomes for urban populations.

The aim is to make transportation more accessible, affordable, and equitable for everyone.

Conclusion

The global auto industry shifts are not just changing the cars we drive; they are fundamentally redefining the very concept of mobility. Driven by the electrification revolution, the relentless pursuit of autonomous capabilities, the integration of ubiquitous connectivity, and the emergence of flexible mobility models, the sector is undergoing an unprecedented overhaul. While the challenges of technological complexity, regulatory adaptation, and immense capital investment are substantial, the collective commitment from established players and innovative newcomers alike signals an unstoppable momentum. This transformative period promises a future where transportation is cleaner, safer, more efficient, and seamlessly integrated into our daily lives, leading to healthier cities, more robust economies, and ultimately, a more sustainable world. The journey ahead is complex, but the destination—a smarter, greener, and more connected future of mobility—is undeniably compelling.